Introducing SKYBIZ® Accounting

SKYBIZ® Accounting software is application software that records and processes accounting transactions within functional modules such as accounts payable, accounts receivable, general ledger, payroll, trial balance, income statement, balance sheet. It functions as an accounting information system.

THE MODULES

Core Modules

- Sales Journal - A sales journal is a specialized accounting journal used in an accounting system to keep track of the sales of items that customers have purchased by changing them to their accounts-receivable account.

- Accounts receivable - where the company enters money received. Customer make payment to us knows as an official receipt is a written acknowledgment. It is a specified note that shows money which has been received as an exchange for product or services. The receipt aims to provide an assurance that the party has paid the expanses of the products which it has purchased. Official receipts can be printable or online and their format and pattern can vary depending upon the requirements of the company.

- Purchase Journal - The Purchases journal is used for recording credit purchases such as merchandise for resale to customers, business supplies, equipment, and other such purchases.

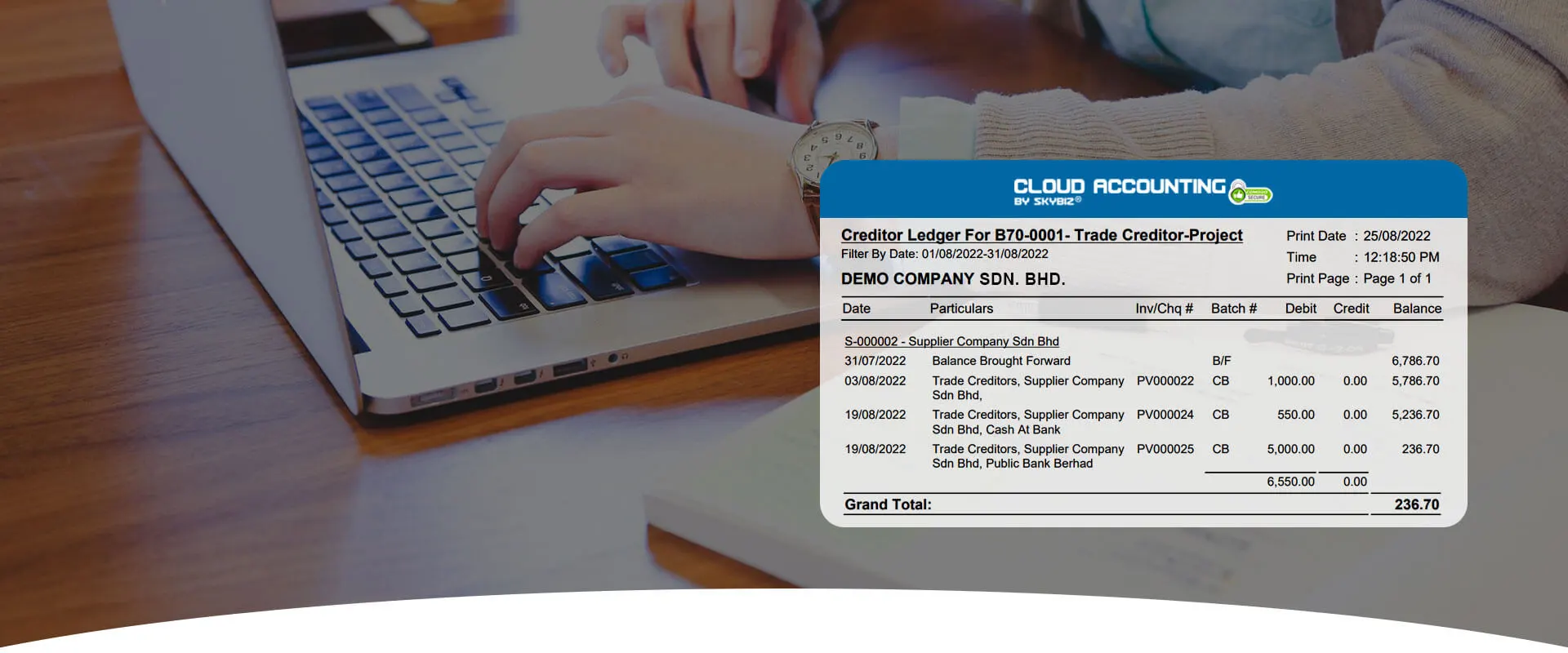

- Accounts payable - where the company enters its bills and pays money it owes.

- General ledger - the company's "books", The General Ledger module is the foundation of your accounting system, with flexibility that meets the current and future financial management requirements of organizations of all types and sizes. It provides a robust feature set designed to handle your most demanding budgeting and processing needs. General ledger fully integrates with all modules and is the key to maximizing the efficiency and accuracy of your financial data. The general journal is where double entry bookkeeping entries are recorded by debiting one/ few account(s) and crediting another/ few account(s) with the same amount. The amount debited and the amount credited should always be equal, thereby ensuring the accounting equation is maintained.

- Cash Book - where the company records collection and payment

Non-Core Modules

- Debt Collection - where the company tracks attempts to collect overdue bills (sometimes part of accounts receivable)

- Electronic payment processing

- Expense - where employee business-related expenses are entered

- Inquiries - where the company looks up information on screen without any edits or additions

- Reports - where the company prints out data

- Reconciliation - compares records from parties at both sides of transactions for consistency. Monthly transaction report will be sent by the bank through a report, which known as Bank Statement. You could make the reconciliation between Bank Statement versus bank ledger by using the software. You could also make the adjustment and print bank reconciliation report if necessary.

- Project Accounting

- Department Accounting

- Branch Accounting

- Consolidation Accounting

- Multi-currency provides capability for maintaining foreign currency transactions along with the base currency transactions in the financials accounts. Any numbers of currencies are supported even for the same account. Solution also provides support for identifying exchange difference as per accounting standards. Multi-currency module all the financial transactions including journal voucher, financial receipts and financial payments. Multi-currency supports all books like journal, bank book, General Ledger, Customer Ledger and Supplier Ledger. Multi-currency support extends to online query of general ledger accounts, customer enquiry and supplier enquiry etc. Full support is provided for trial balance, aging analysis in foreign currency and customer outstanding statement.

SUPPORTED BUSINESSES

Some business accounting software is designed for specific business types. It will include features that are specific to that industry.

The choice of whether to purchase an industry-specific application or a general-purpose application is often very difficult. Concerns over a custom-built application or one designed for a specific industry include:

- Smaller development team

- Increased risk of vendor business failing

- Reduced availability of support

This can be weighed up against:

- Less requirement for customization

- Reduced implementation costs

- Reduced end-user training time and costs

Some important types of vertical accounting software are:

- Banking

- Construction

- Medical

- Non-Profit

- Point of Sale (Retail)

- Daycare accounting (or Child care management software)

-

Cash Book Management

- Cash Book

- Cash Flow Budget Statement

- Outstanding Cash Book / Invoices

- Weekly Cash Flow Statement

- Payment Listing

- Receipt Listing

-

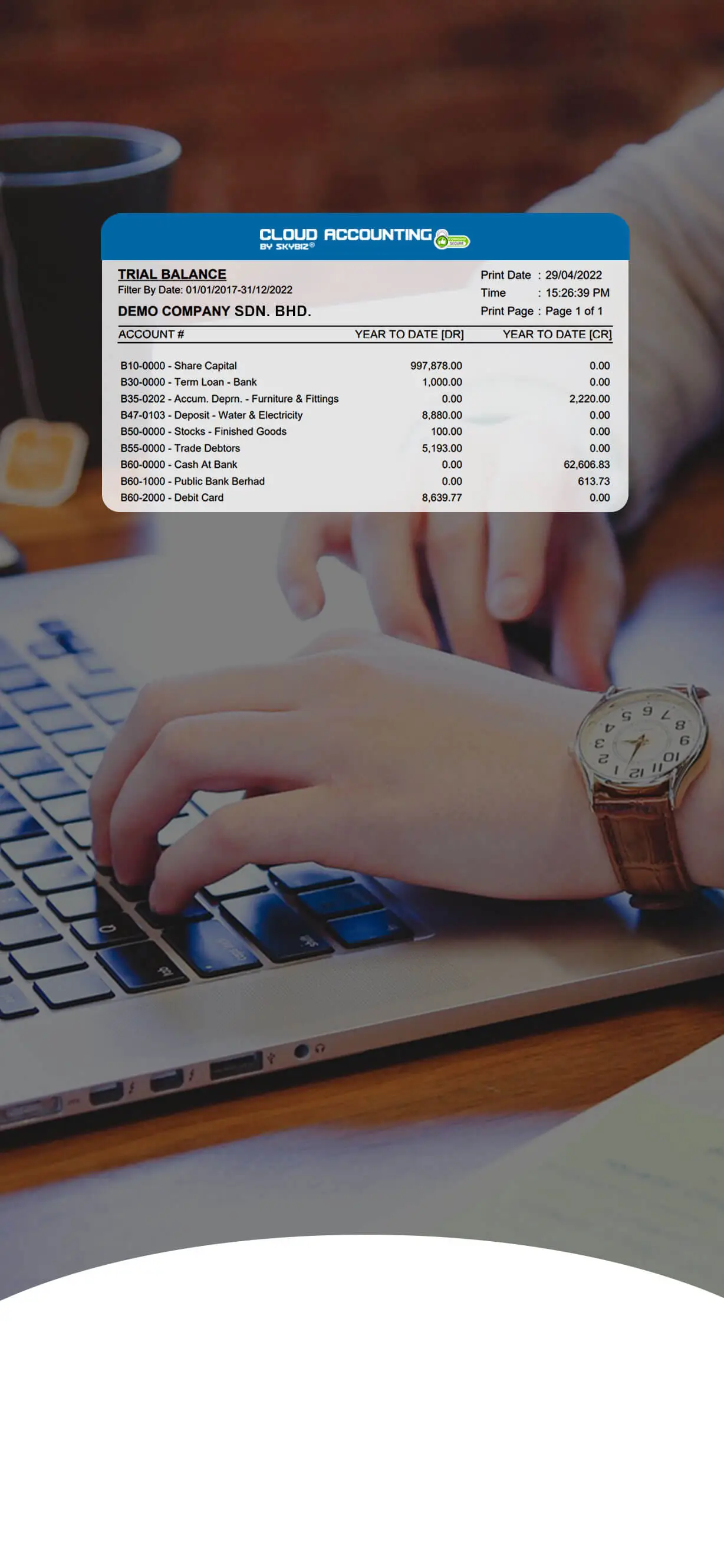

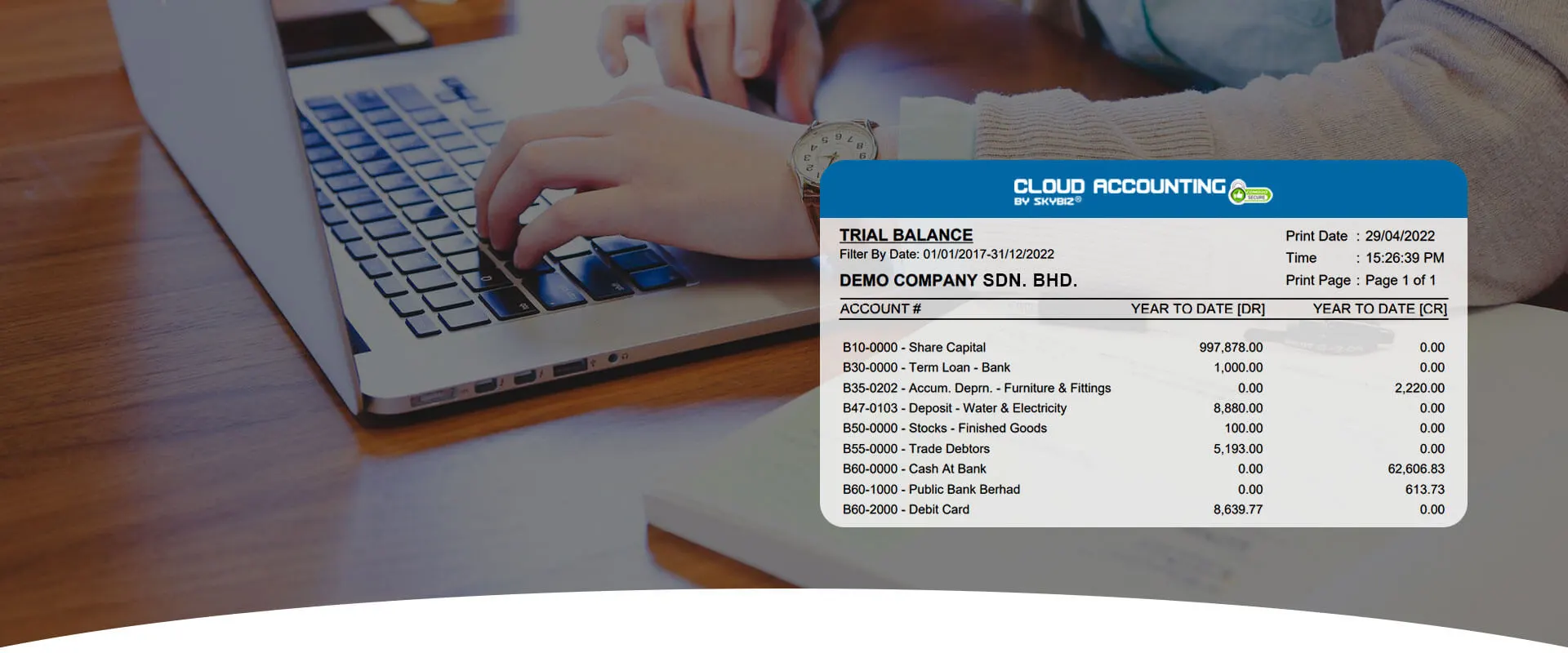

General Ledger

- Print Ledger

- Trial Balance

- Trial Balance 4 Columns

- Income Statement

- Income Statement (4 Columns)

- Income Statement (Last Year vs This Year)

- Income Statement For 12 Months

- Payee Ledger Journal

- Balance Sheet

- Manufacturing Account

- Manufacturing Account For 12 Months

- Chart of Account

- Journal List

- Journals By Batch

- Account Enquiry

- Property, Plant & Equipment

-

Account Receivable Report

- Customers Statement By Month (Open Item)

- Customers Statement By Month (open Item)-Payment vs Invoice

Customers Statement By Month (Balance forward) - Customers Statement By Month (UnMatch only)

Customers Listing - Print Label

- Customers Detail Aging Analysis

- Customers Summary Aging Analysis

- Customers Detail Overdue Aging Analysis

- Customers Overdue Aging Analysis

- Customers Detail Aging Analysis_PD

- Customers Summary Aging Analysis-PD

- Customers Ledger

- Print Overdue Reminder Letter

- Print Overdue 2nd Reminder Letter

- Print Overdue Final Reminder Letter

- Customer Overdue Invoice Statement

- Customer Payment Overdue Days

- Customer Outstanding Bills

- Gain or Loss Exchange Rate

- Post Dated Cheques Received

- Customer Matching Listing

- Customer Matching Listing [Collection Vs Invoices]

- Customers Engury

- Customers Details Transactions

- Customers Collection Analysis

-

Project Report

- Project Listing

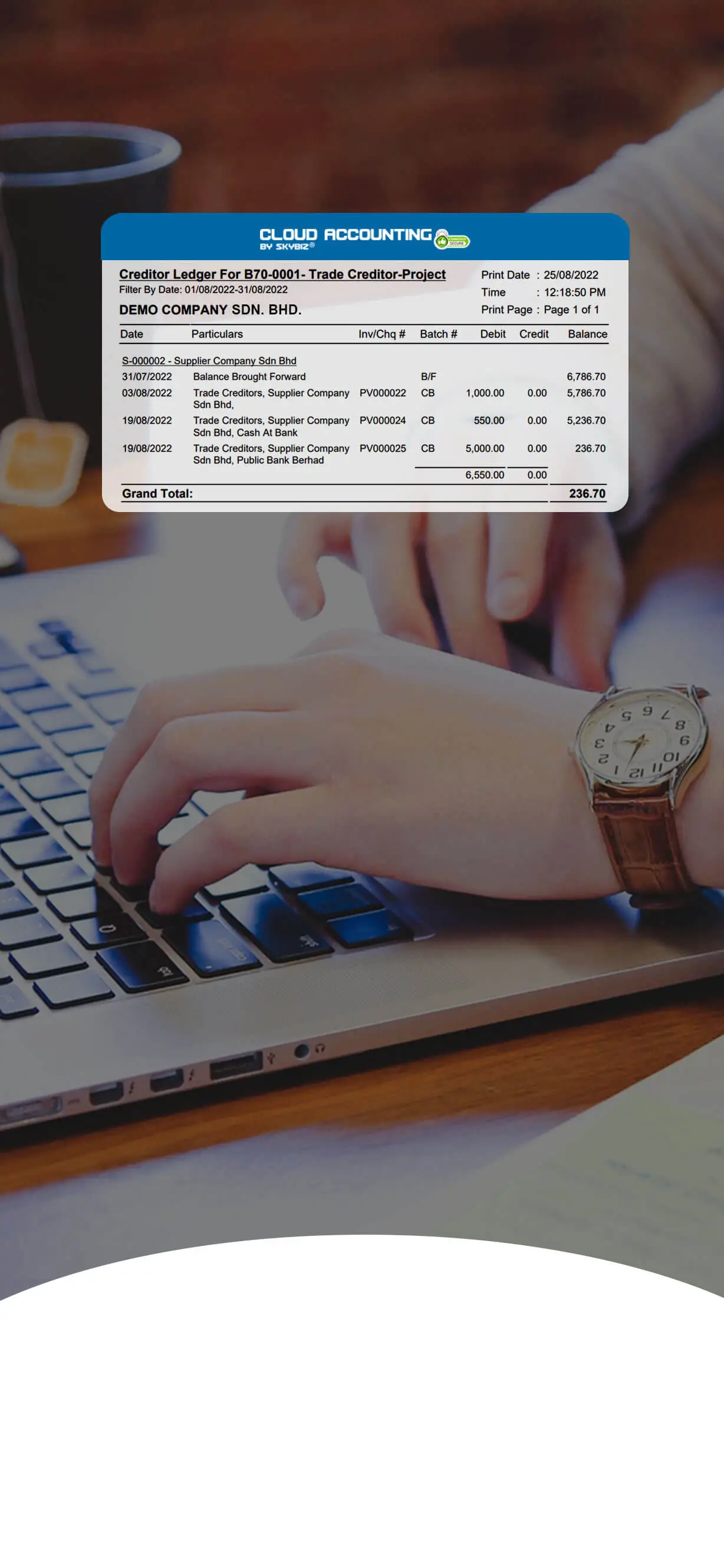

- Project Ledger

- Project Customer Ledger

- Project Supplier Ledger

- Project Income Statement

- Project Income Statement-Consolidated By All Project

- Project Income Statement 12 Months

- Summary Of Project Profit/Loss (By Years)

- Summary Of Project Profit/Loss (By Month)

- Project Income Statement-Consolidated By Selected Project

- Branch Income Statement-Consolidated by seleted Project

- Project Trial Balance

- Project Balance sheet

- Project Manufacturing Account

- Project Customer Summary Aging

- Project Customer Detail Aging

- Project Supplier Summary Aging

- Project Supplier Detail Aging

- Project Supplier Matching Listing

- Project Vs Department

- Project Yearly Summary By Department

- Supplier Yearly Summary By Project

- Summary Of Supplier Vs Project

- Project Weekly Cash Flow Statement

- Project Expenses Report

- Project Sales Analysis By Date

- Project Cash Book

- Project Receipt Listing

- Project Payment Listing

-

Budget Report

- Profit and Loss With Budget

- Profit and Loss With Budget (This Year Vs Last Year)

- Profit and Loss With Budget (This Year Vs Last Year,This Month Vs Last Month)

- Manufacturing Report With Budget (This Year Vs Lass Year)

- Project Income Statement With Budget

- Project Income Statement With Budget (Format2)

- Project Income Statement With Budget(Format3)

- Budget Variance

- Weekly Budgetetary

- Project Budget Variance

-

Sales Report

- Sales Analysis By Date

- Sales Analysis By Customer

- Sales Analysis By Salesman

- Top Customer Sales Report by Sort by Yearly Total Amount

-

Account Payable Report

- Supplier Remittance Advice-(Brought Forward)

- Supplier Remittance Advice-(Open Item)

- Suppliers Listing

- Print Label

- Suppliers Detail Aging Analysis

- Suppliers Summary Aging Analysis

- Suppliers Detail Overdue Aging Analysis

- Suppliers Overdue Aging Analysis

- Suppliers Ledger

- Suppliers Payment Overdue Days

- Supplier Outstanding Bills

- Gain Or Loss EXchange Rate

- Post Dated Cheques Issued

- Suppliers Matching Listing

- Suppliers Enquiry

- Suppliers Details Transactions

- Suppliers Detail Aging Analysis(By TaxDate)

- Suppliers Summary Aging Analysis(By TaxDate)

-

Purchases Report

- Purchases Analysis By Date

- Purchases Analysis By Supplier

-

Salesman Report

- Customers Detail Aging Analysis-By Salesman

- Customers Aging Analysis-By Salesman

- Customers Detail Aging Analysis-PD-By Salesman (Matched)

- Customers Aging Analysis-PD-By Salesman

- Customers Detail Aging Analysis-PD-By salesman

- Salesman Sales And Collection Analysis (By Months)

- Salesman Collection Analysis

- Salesman Collection Aging Analysis

- Salesman Commission Report

-

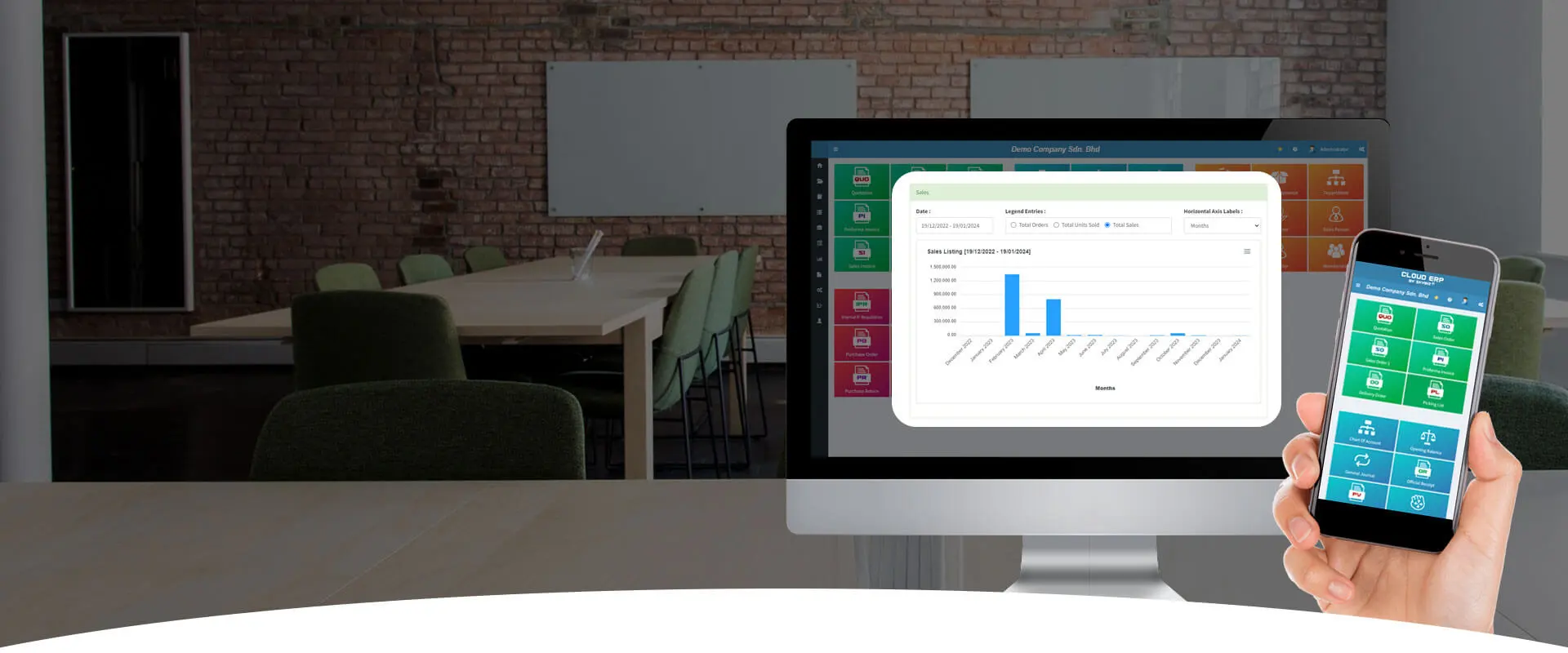

Chart Analysist Module

- Sales Analysis Chart

- Purchases Analysis Chart

- Monthly Bank Balance Analysis Chart

- Monthly Expenses Analysis Chart

- Monthly Budget Analysis Chart

- Branch Sales Analysis Chart

- Branch Purchases Analysis Chart

-

Tax Report

- Tax Transaction Listing

- Tax View Total

- Statement Of Tax Detail

- Statement Of Tax Summary

-

Consolidate Account

- Trial Balance

- Balance sheet

- Income Statement

- Integrated With MyDistribution Reports

- Account Receivable Report

- Customers Detail Aging Analysis(With SO)

- Customers Aging Analysis(With SO)

- Customers Detail Aging Analysis-PD(With SO)

- Customers Aging Analysis -PD(With SO)

- Account Payable Report

- Suppliers Detail Aging Analysis(With PO)

- Suppliers Aging Analysis(With PO)

-

Foreign Currency Report

- General Ledger

- Print Ledger Listing

- Bank Account Realise Gain/(Loss)

- Customers

- Customers Ledger

- Customer Statement(Brought Forward)

- Customer Statement(Open Item)

- Customer Detail Aging

- Customer Summary Aging

- tomer Unrealise Gain/(Loss)

- Customer Matching Listing

- Suppliers

- Suppliers Ledget

- Suppliers Remittance Advice

- Supplier Detail Aging

- Supplier Summary Aging

- Supplier Unrealise Gain/(Loss)

- Supplier Matching Listing